The Fascinating Life of an Insurance Agent

The 40 Year Anniversary of JS Downey Insurance Service was August 1st, 2019!

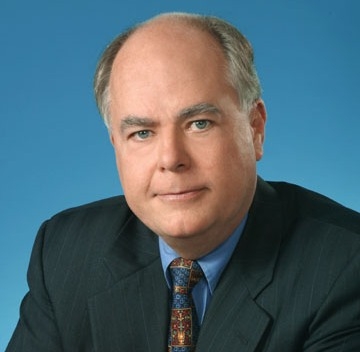

Steve Downey, Founder, JS Downey Insurance Service

Dear Reader,

Skim to the questions that interest you - there are a lot of useful nuggets on leadership and growing a business… insights into the insurance world (or becoming an agent)… and likely some surprising facts you never knew about Steve.

Happy Anniversary, Steve, that’s an amazing accomplishment. Why did you choose the insurance industry?

In March 1974 during my final semester at USD, they held a Career Day. Several companies showed up to recruit graduating students. I was offered a contract with AETNA Insurance and began my career on June 1st, 1974!

At that time, I was a Life Insurance agent. During the next 5 years (before I purchased my own agency), I learned about annuities and individual, group, and commercial insurance.

Tell me about the founding of the agency in 1924?

1924 was the original date that Howard Rowe got appointed as an independent agent at Hartford Insurance company.

That marked the beginning of the agency.

Howard began the agency in Encinitas and moved it to La Jolla in the 1940s where he purchased a house and built an office at 844 Prospect, La Jolla, CA 92037.

His son got into the business in the early 1950s and continued the agency under the same name.

How did you acquire the agency?

In 1979, Howard decided to sell the agency and I acquired it through an installment purchase on August 1st, 1979.

About 5 years later, I changed the name to James Stephen Downey Insurance Service, which later became JS Downey Insurance Service.

That’s a long time to be doing insurance.

Over 40 years, I’ve developed hundreds of friends and clients that I’ve continued to service over the years, so it’s been an incredible business - both personally and financially.

It provided a good living for my family and allowed me to be my own boss and become an agency manager as well as a producer.

Tell me a little about your upbringing and how that may have influenced you as an entrepreneur?

I was the youngest of 10 children. My oldest sibling was born in 1930. I was born in 1952.

Steve and his siblings ~1995

I definitely attribute some of my entrepreneurial skills to my parents. My father had his own musical entertainment business which my mom helped administer. Both of my parents were self-employed and responsible for their own income.

They managed hundreds of people over their lifetime - entertainers, musicians, band members, and an orchestra.

I never knew! What is the coolest event where your dad performed?

My dad owned Jimmy Downey Entertainment - he was a big Band Leader and Drummer from the early 30s - to the 1950s.

His highlight was likely playing for Harry Truman at one of his inaugural balls. They both came from Missouri. It was definitely a career highlight for my dad.

How did you approach your leadership role while growing your agency?

My degree was in Business Administration which provided the academic introduction to management. Of course, that’s all theoretical until you actually own your own business.

I’ve taken Executive courses, had extensive sales training, read hundreds of books, I’m not afraid to take risks - but nothing prepares you for leadership and growth more than on-the-job training, trial and error, feedback from employees, and above all, self-awareness.

The ability to question things that aren’t working and being willing to change things up. Failing is a really good teacher. I’ve grown as the agency has grown.

Any particular interesting stories from the world of insurance - good or bad?

One of the most heartbreaking stories was a friend and client of mine who owned a computer store. He let his business owner policy lapse - and a month later, he had a fire that took out his entire store. It even overlapped into other businesses. He had no policy in effect.

As far as a “good” story, that’s a bit of a conundrum. In the insurance world, something negative happens, and then insurance covers you.

Insurance is about bringing peace of mind to families and businesses. It’s about protecting a person from a devastating financial loss.

One particular story that comes to mind is sad, but with a happy ending.

A client of mine immigrated here from Jordan in 1987 with his wife and two young children (ages 1 and 3).

Inside the agency

He secured 2 million in life insurance. About 10 years later, he developed cancer and passed away.

Thankfully, due to his policy, his wife and kids were able to continue their lifestyle and not fear running out of money.

How has the agency grown since you took over?

I’ve always been confident in my ability to build trust and nurture customer relationships.

Being willing to take risks acquiring existing agencies (that already had established relationships), I was able to grow the firm year after year.

The agency book of business has grown 1000% (or approximately 6% per year) since I purchased it in 1979.

Advice for aspiring insurance agents?

The national average income for an agent isn’t that enticing. But I earn 6 times the national average of an insurance agent - and anyone else can, too. Insurance sales is a long game, not a get-rich-quick type of business. The rewards for surviving can be exceptional in many ways, beyond counting shekels.

Count on 3 - 5 years of grinding it out before considering yourself a winner. Every relationship matters along that path. Networking, building trust, and expanding your product offerings. The agent should grow with their clients as their needs evolve over their lifetime.

If it were easy there would be a lot more folks in this business . . . making a lot less money. Chances of being successful as an insurance agent age 21 was 1 in 100 and to make it 45 years is 1 in 100,000 (my guess). I’m definitely grateful.

Tell me about your team and how that makes your agency excel?

The main methodology I used was for me to be in contact with the client, and then have a support team behind me. The client often interfaced with me - I was interfacing with staff - my team did the work to get me the information I needed to deal with the client.

I didn’t turn clients over to staff members for many years. Clients appreciated that they were dealing principally with me.

Over time, the ability to handle all the details had to be distributed to staff. And I’ve had a good opportunity to have a good personal lines manager for 24 years (Joanne) and added another benefits manager who’s been with me for about 12 years (Nancy) and then recently added a skilled employee benefits manager who has 27 years experience (Diane).

My wife, Marilyn, had been a regional VP for Anthem Blue Cross for 22 years and we’ve been together for 24 years. With her experience, she’s in the agency as both a producer of senior benefits (Medicare) and assists me in the management of the agency.

I support my staff in their professional development. Every insurance carrier offers training, we offer online HR and employee training through our own site, and I encourage every one of them to continue pursuing higher education.

They all have potential for growth within the agency.

I respect every employee.

A Stephen Covey quote comes to mind, “Always treat your employees exactly as you want them to treat your best customers.”

Future goal(s) of the agency?

Recently, we merged with another agent, Michael Freeman, from Countywide Health Insurance Services. We knew that together, we could develop deeper staffing so we can take a back seat to day-to-day operations - eventually turn the agency over to the people who know the clients and the business the best.

Arlene Maguire

Before that, we merged with Maguire Health Insurance Services (a family owned business) in 2014. Arlene Maguire and my wife, Marilyn, developed a friendship in the early days of insurance meetings and carrier presentations.

When it became time for Arlene to consider retirement so she could care for her husband with Alzheimer’s, she had a lot of people interested in her agency. She decided that JS Downey would be the ideal facilitator and caretaker of her book of business because she always put her customer relationships above anything else.

I hired her daughter, Shari Gittleman, to stay on board and help with the transition, as well as handle all our site content and marketing needs. She remains with us to this day. She’s interviewing me right NOW - and she’s become part of the JS Downey insurance family.

What are your views of the insurance industry?

Technology has changed the insurance business. Agents have transformed from quite a bit of service - that is now done by the company - including creation of policies, invoicing, claims management and policy renewal - to now devoting more time on business development.

The trade-off was reduced compensation - so we became more insurance producers instead of insurance servicers. The same thing occurred with commercial lines - as well as employee benefits - they have become a commodity with less and less need of servicing from the agent.

As far as the Affordable Care Act (“Obamacare”), because the compensation was reduced by over 50% in many cases, it creates a dilemma for the agent. There’s not enough compensation to provide excellent service as in the past.

For the average agent, revenues depreciated so greatly, agents were forced to reduce their staff or they didn’t grow. It reduced the time we spent on education for the clients, the advisory roles we normally took on. In many cases, agents left the individual market completely.

Why use an agent?

We’re able to ask personal questions of the client to discern what policy would best fit an individual. Normally carriers are not interested in the personal situation and just sell the policy that a client wants, but it might not be the right solution.

Add to that, the complexity of health insurance - it’s not defined by a copay or deductible. It’s defined by a variety of variables - pricing, doctor availability, taxation, budgets, as well as the person’s health history.

We often present alternative funding methods for small businesses, like HSA’s - Health Savings Accounts and FSA’s - Flexible Spending Accounts. This helps lower costs for both employers and their employees.

Another great reason to use an agent - there is no cost to the consumer!

Small business owners will be reading this...

Any tips or advice on running a successful company for so long?

To keep the agency growing throughout an ever-changing industry, while still maintaining a high level of service, that requires expanding the lines of insurance we offer to meet every need of our customers, as well as hiring and maintaining an agency full of people who care. They need to know the stories of these families and businesses and be able to find the best fit (to reduce their exposure to risk) throughout their lives.

Steve and Marilyn’s Dog, Murphy - Working At the Office

A business owner has to be willing to take on new ideas and information and incorporate those ideas into the sales and service process - that’s what differentiates a leading agent from a processing agent.

Final words of wisdom for entrepreneurs?

I think good leaders have their employees’ backs. I value my employees - they in turn, create value for my business.

I believe and hope my employees care about the success of the agency, not only their paychecks. That’s what I have in mind when I’m hiring them.

It’s important to show them gratitude for the many things they do to make our clients’ lives better. There are things they do on a daily basis that make our agency better - and I may never even hear about it. I’m grateful for everything they do.

It’s one of the many reasons we continue to grow despite the changes in the industry. We need to have the extensive knowledge and product offerings, but never forget our core business is being of service to our clients. Customer relationships based on competency, service, and trust.

Long term, lasting relationships, repeat business, lots of referrals and good will are what I am proud of. The length of time we serve our clients is the testament of good business.